The blank check generators come up with a pre-structured unsigned check format with readymade sections for the payee, the check value, the date and so on. You don’t get much scope of making a mistake in writing checks because overwriting is not allowed and it may lead to cancellation of the check. For checks printed with other programs, order envelope 40-338. It is used to request an advance payment of the tax credits for qualified sick and qualified family leave wages, and the employee retention credit. Check the box to indicate which employment tax return form you file (or will file for 2021). As a part of the tax relief effort for affected businesses. The official title of this form is the Advance Payment of Employer Credits Due to Covid-19. Who can file form 7200? Do they just send via check? 1 Employee x $12,000 in quarterly wages = $12,000 $12,000 - $10,000 (max qualifying wage amount) = $10,000 If you make an error, simply fix it when you file your respective payroll tax returns. From standard to High Security, our laser computer checks and blank stock checks are guaranteed to be compatible with your accounting software, whether that be Quicken, QuickBooks, Sage50, and many more. They will need to know: Please provide this information per form 7200 filed. Check stock security that is designed for computer printed and e-checks. We’ve got all your baking equipment sorted so you can easily perfect your signature bake from start to finish.

Form 7200 is used by eligible employers and small employers to request advance payment of the employee retention credit and the FFCRA credits that an employer claims on employment tax returns such as Form 941, Employers Quarterly Federal Tax Return. A third-party solution that allows you to use blank paper checks for all of your bank accounts. Blank check stock that is designed for computer printed checks. Last day to file Form 7200: Taxpayers filing a Form 941, 943, or 944 have up to the earlier of Februor the date you file the Form 941 for the fourth quarter of 2020, Form 943, or Form 944.

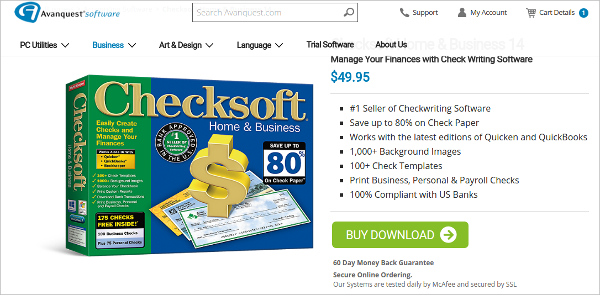

900 high quality business checks, 3-Up standard business style Form #7000 - Highest quality, 24 lb checks - Bank approved in the US Print complete or blank checks with Quicken, Quickbooks, Microsoft Money and all versions of Checksoft¿, M圜heck Writer and VersaCheck products Proven anti-forgery and anti-counterfeiting security features Blank check templates can be an ideal way of teaching the kids as well as adults about the dos and don’t of issuing checks. If you are unsure if you should still file a form 7200, please reach out prior to filing to avoid a double claim. Please select options before adding to cart. They insisted on using Square to handle their payroll, and of course, Square does not give them the ability to reduce payroll tax deposits. Check Stock with 12 Unique Security Features. That said, depending on the deposit frequency of your business, you may deem it faster to request an advance payment of those credits rather than reducing your tax payments, in order to keep your cash flow more consistent. Check only one box for the applicable calendar quarter. Generally, employers that file Form (s) 941, 943, 944, or CT-1 may file Form 7200 to request an advance payment of the tax credit for qualified sick and family leave wages and/or the employee retention credit. File Form 7200 for requesting advance payment of tax credits for Forms 941, 943, 943, and Form CT-1. As a result, the second quarter 2020 Form 941 has been extensively revised.

Customers prefer to make operations on the money with the bank check … Check only one box for Part 1, Line A. Instead, you only need to purchase blank check forms.

0 kommentar(er)

0 kommentar(er)